The Rich Pay for the Federal Government

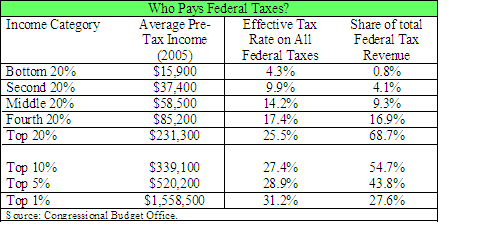

Despite all the deductions, loopholes and clever accountants the federal income tax is strongly progressive. Moreover the federal tax system remains progressive even if you include the payroll tax, corporate taxes and excise taxes. The chart below with data from the Congressional Budget Office, shows the effective tax rate by income class from all federal taxes. Effective tax rates are considerably higher on the rich than the poor.

The effective tax rate is higher on the rich and the rich

have more money – put these two things together and we can calculate who pays

for the federal government. The final

column in the table shows the share of the 2.4 trillion in federal tax

revenues that is paid for by each income category. The remarkable finding is that the rich and

especially the very rich bear by far the largest share of the federal tax

liability. The top 10% of households by

income, for example, pay more than half of all federal taxes and the top 1% alone pay over a quarter of all federal taxes.

(Click the table if it is not clear.)